EQUIPMENT FINANCING ASSISTANCE

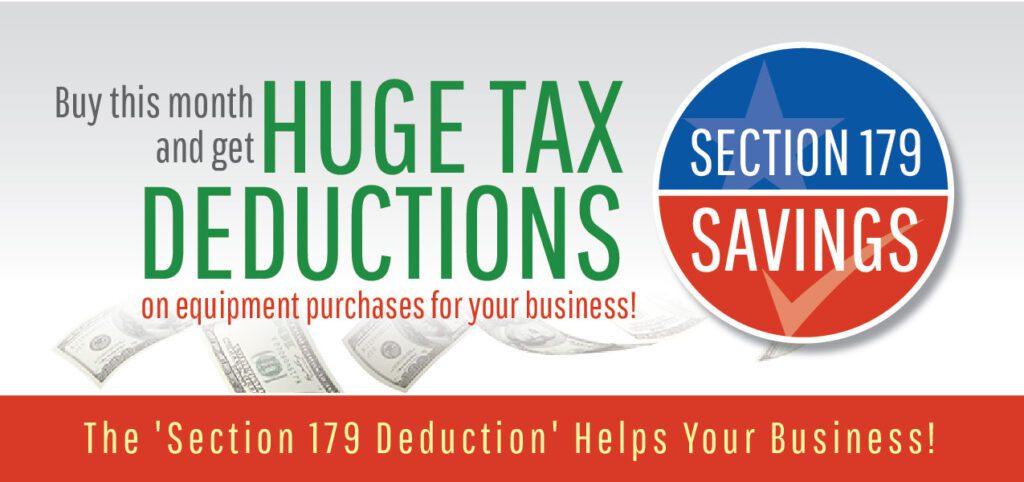

Flexible customer solutions to help customers to buy equipment and preserve working capital:

• Flexible terms including deferred payments up to 6 months (perfect for new or expansion practices)

• Up to 84 month (7 year) terms for equipment costing over $40,000

• Different buyout options at the end of lease (10%, Fair Market Value, and $1.00 Buyout) to assist

customers with monthly cash flow, along with the desired tax benefits for equipment purchased.

WHAT WE CAN DO FOR YOU

Our goal is:

We provide a variety of structure/payment terms to assist with the customer’s cash flow. Examples are $0 down/deferred payments (buy now/start payments next year), step payments & seasonal payments.

The process includes:

• Quick & simple credit application

• Analysis of obtaining credit approval for harder credits (including start-up and existing chiropractors)

• Fast credit approval

• Constant updates throughout the credit/funding process

• Pre-funding (when deposits are necessary)

• Quick funding (with equipment delivery) with only faxed documents in many cases

Success comes from WHO you know not WHAT you know! Nashwa Financial Services has 20 years of experience in the medical/X-ray industry. Our priority is to offer effective financial sales tools to assist in selling equipment. Once an application is received, we offer fast, flexible service, constant communication, very competitive terms, along with the highest percentage of credit approvals. Nashwa Financial Services offers a proven track record of experience, with competitive solutions while providing a “One stop does it all”

Nashwa Financial provides equipment lease/finance options for medical practices including start-up

Medical Doctors (All Specialties)

• Veterinarians

• Orthopedics

• Podiatrists

• Chiropractors

• Urgent Care Facilities

• Dentists

• Hospitals

Flexible customer solutions to help customers to buy equipment and preserve working capital:

• Flexible terms including deferred payments up to 6 months (perfect for new or expansion practices)

• Up to 84 month (7 year) terms for equipment costing over $40,000

• Different buyout options at the end of lease (10%, Fair Market Value, and $1.00 Buyout) to assist

customers with monthly cash flow, along with the desired tax benefits for equipment purchased.